The major global streaming platforms will invest $42bn in original and acquired film and TV content in 2023, according to research by Ampere Analysis.

This marks a slower combined rate of growth for streamers Netflix, Amazon Prime Video, Disney+, Apple TV+, Paramount+ and Max/HBO Max of 7% year-on-year, compared to the 24% growth in streaming spending witnessed in 2022.

Ampere said that, amid intense competition and a challenged global economy, the SVoD platforms will prioritise cost management and effective content acquisitions to thrive in 2024 and beyond.

Of the $42bn in SVoD content spend dedicated to TV series and films, 90% is for scripted.

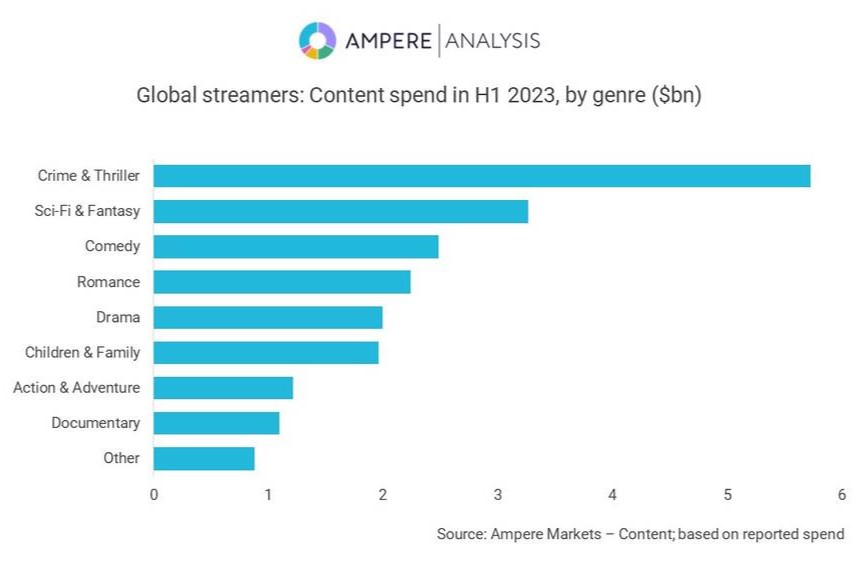

Crime & thriller tops SVoD spending, with investment expected to hit $12bn this year. The sci-fi & fantasy and comedy genres also command substantial funds.

At a platform level, Ampere said that Netflix and Amazon Prime Video are adopting a balanced approach to genre allocation, leveraging their scale to cater to the preferences of diverse demographics.

Other SVoD players are pursuing more targeted spending strategies, focusing on key genres and IP to cultivate subscriber bases. Apple TV+ dedicates 40% of its budget to crime & thriller titles, building on past successes such as Slow Horses and Severance. Disney+ has prioritised sci-fi & fantasy and children & family genres, anchored by TV spin-offs from the Star Wars, MCU and Pixar franchises.

Ampere said that streamers are increasingly turning to entertainment and reality as their budgets tighten and they search for subscriber engagement at a lower cost. Spending on unscripted content by SVoD platforms is set to hit $4.9bn this year, growing by 22% year-on-year, vastly outpacing the overall rise in spending by global streamers. An initial focus on documentaries has expanded to encompass entertainment and reality, with a particular focus on both producing and acquiring dating, talk show and game show formats.

Neil Anderson, Senior Analyst at Ampere Analysis, said: “In 2023, we forecast that major global SVoD platforms will collectively invest $42bn in film and TV content. The moderated spending growth rate in comparison to previous years underscores the maturity of the SVoD market and the importance of strategic spending across genres. At $15 billion, Netflix will retain its position as the top investor in global streaming content, albeit with a modest 2% increase. Meanwhile, rivals such as Disney+, Paramount+, and Apple TV+ are poised for more substantial budget expansions, projecting year-on-year increases exceeding 10%.”

You are not signed in

Only registered users can comment on this article.

Rai sports boss resigns after Winter Olympic commentary errors

Paolo Petrecca, Director of Rai Sport at Italian state broadcaster Rai, has resigned after a series of commentary errors during the Milano-Cortina Olympics opening ceremony.

BBC names Directors of Entertainment and Factual

The BBC has restructured its unscripted commissioning department, naming Ed Havard as Director of Entertainment and Fiona Campbell as Director of Factual.

WBD mails definitive proxy statement to finalise Netflix merger

Warner Bros. Discovery (WBD) will hold a special meeting of shareholders to vote on the merger with Netflix on March 20, 2026. In the meantime, WBD has begun mailing the definitive proxy statement to shareholders for the meeting.

Sky's talks to acquire ITV slow down

Talks by Sky to acquire ITV’s broadcast channels and streaming platform have slowed in recent weeks, according to a report by Reuters.

Bytedance pledges to rein in Seedance AI tool

Chinese technology giant ByteDance has pledged to curb its controversial artificial intelligence (AI) video-making tool Seedance, following complaints from major studios and streamers.

.jpg)