The global advertising market will have grown by 6.8% by the end of 2024 to close at $772.4bn, according to Dentsu’s latest Global Ad Spend Forecasts report.

Global marketing and ad agency Dentsu said its growth projection for 2024 has been revised up following the return to double-digit growth (+10.7%) of digital ad spend, the impact of sporting and political events, and improved outlooks across the US, UK, Brazil, and France.

.jpg)

Looking ahead, Dentsu said that ad spend growth is forecast to continue at 5.9% in 2025, outpacing the global economy by 2.7 percentage points.

The Americas are expected to lead in 2025 with 6.3% growth, driven by robust US and Brazilian markets where digital and streaming see sustained investments.

The Asia-Pacific market is forecast to increase by 5.8%, with AI-driven ad placements contributing to the increase in digital ad spend in markets like India.

For EMEA, Dentsu has projected growth of 5%, with strong digital performance in key markets.

Ad spend is in the UK is expected to grow by 7.5% in 2024 and 5.7% in 2025 to reach $51.7bn, thanks to strong growth from digital media.

Dentsu said the ad industry has entered what it calls the algorithmic era with data-enabled advertising increasingly shaping media strategies. It predicted that algorithmically-enabled ad spend would reach 79% of total ad spend by 2027.

From a media channel standpoint, dentsu highlights that digital is expected to remain the fastest-growing channel, with a projected increase of 9.2% in 2025 to reach $513bn and capture 62.7% of global ad spend.

Television ad spend growth is forecast to show marginal growth of 0.6% in 2025, with connected television rapidly increasing (+18.4%) thanks to ad-supported streaming, and broadcast television declining (-2.5%).

Meanwhile, print media continues to contract, while cinema and out-of-home (OOH) advertising continue to grow by 3.2% and 3.9%, respectively.

Significant ad spend increases are anticipated in the finance (+6.4%), pharmaceutical (+5.8%) and travel and transport (+5.5%) sectors.

Jenny Bullis, Media Practice CEO UK&I at dentsu, said: “Digital spend continues to outpace other channels, as brands take advantage of the depth and pace of connection it powers with their customers. As competition for consumer engagement grows, harnessing the algorithms that serve our media is key to delivering business value from this investment.”

You are not signed in

Only registered users can comment on this article.

John Gore Studios acquires AI production specialist Deep Fusion

UK-based film and TV group John Gore Studios has acquired AI specialist production company Deep Fusion Films.

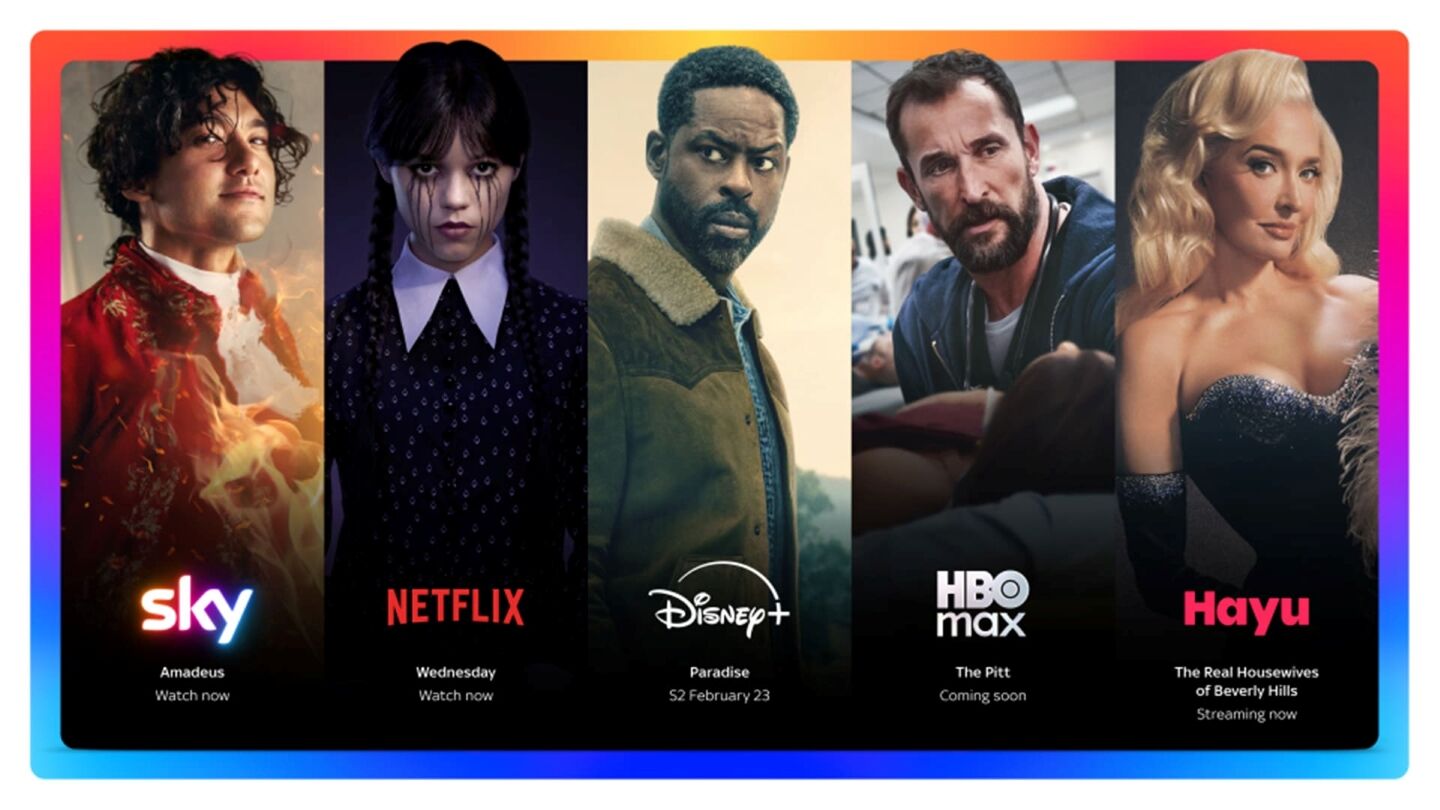

Sky to offer Netflix, Disney+, HBO Max, and Hayu in one subscription

Sky has announced "world-first" plans to bring together several leading streaming platforms as part a single TV subscription package.

Creative UK names Emily Cloke as Chief Executive

Creative UK has appointed former diplomat Emily Cloke as its new Chief Executive.

Rise launches Elevate programme for broadcast leaders

Rise has launched the Elevate programme, a six-week leadership course designed to fast-track the careers of mid-level women working across broadcast media technology.

Andrew Llinares to step down as Fremantle’s Director of Global Entertainment

Andrew Llinares is to step down this spring from his position as Director of Global Entertainment at global producer and distributor Fremantle.