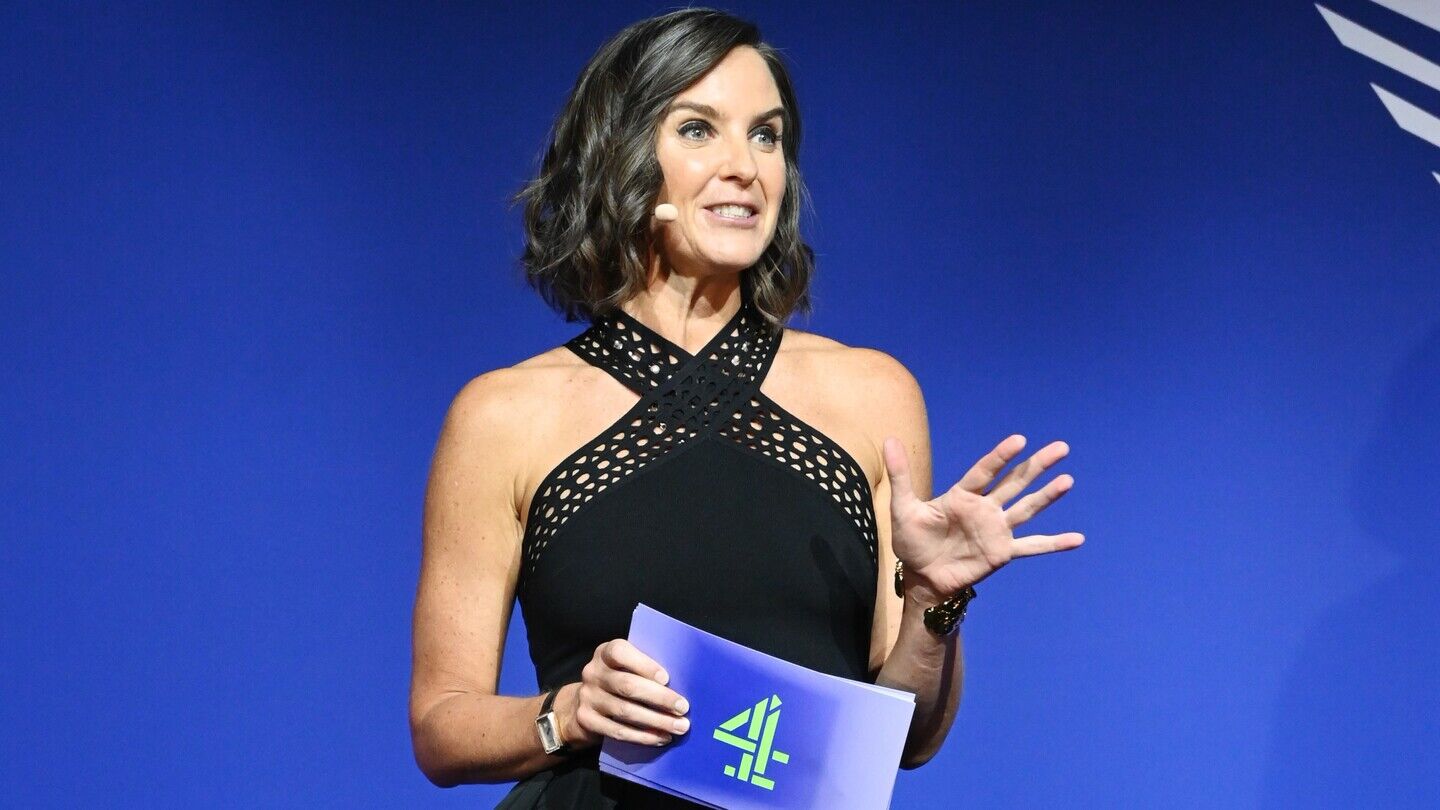

Channel 4 has announced that Alex Mahon will step down as CEO this summer. Mahon joined the organisation in 2017 as the channel’s first female CEO.

Mahon secured Channel 4’s public ownership through two privatisation attempts while transforming it into a digital-first public service streamer.

Channel 4’s Chief Operating Officer, Jonathan Allan, will serve as interim CEO while the board seeks a successor.

Dawn Airey, Channel 4 Interim Chair, said: “Alex is a great figure in British television. She has been one of the most impactful CEOs since Jeremy Isaacs’ founding of Channel 4 more than 42 years ago.

“She is business minded and has also been transformational both culturally and creatively, proving time and again her extraordinary ability to inspire and drive positive and meaningful change. Under her leadership, Channel 4 has moved with the times and driven the times.

“Her commitment to Channel 4’s public service mission has been unwavering. She has backed entertaining, shocking, interesting telly, never playing it safe and her grit and resilience more than met the rough-tough challenges of recent times.

“She leaves a strengthened and well-run Channel 4 that will continue to flourish, with its Fast Forward strategy reengineering the organisation for the future.

“While change is never easy, especially when so consequential, I could not be more pleased that Jonathan Allan, our excellent Chief Operating Officer, will serve as interim CEO while the Board focuses on a permanent replacement for Alex.”

Mahon said: “Working at Channel 4 has been a lifetime privilege because Channel 4 is the most extraordinary organisation. What we get to do here is much more than television because we reflect our country with humour, creativity, grit, and care. We try our best to challenge convention and to change conversations. And we do it with a kind of irreverent brilliance that simply doesn’t exist anywhere else.

“I feel lucky beyond belief to have had the chance to lead Channel 4 for nearly eight years – through calm seas (very few) and stormy waters (more than our fair share). From navigating the threat of privatisation (twice), to shifting out of London, to digital transformation, lockdowns, political upheaval, advertising chaos – there has never been a dull moment. But through every twist and turn, there’s been one constant: the astonishing calibre, resilience, and creativity of all my colleagues at Channel 4.

“Together, I hope that we have evolved what Channel 4 means and what it stands for. We’ve protected the brand, even as we reinvented it. We’ve stayed risky, relevant and relentlessly new – with 60% of our shows fresh each year. And through it all, it’s been the programmes – and their impact – that have brought me the most joy and pride.

“Most recently, the Paralympics changed lives. It changed perceptions. And that really matters.

“And in the last few months our Gen Z work – giving voice to the experiences of a generation too often overlooked and spawning so many national conversations – is another example of why Channel 4 has to exist.

“Shaping the national conversation in ways no other broadcaster dares to. Doing things that are bigger than programmes. Not just public service – actual public impact."

You are not signed in

Only registered users can comment on this article.

HbbTV Association formally integrates DRM in HbbTV 2.0.5

The HbbTV Association has published version 2.0.5 of its core specification, which formally integrates digital rights management (DRM). While HbbTV devices have supported DRM for many years, this is the first time it has been explicitly defined, providing a harmonised, interoperable approach across the ecosystem.

Netflix withdraws from race to acquire Warner Bros Discovery

Netflix has withdrawn from the race to acquire Warner Bros Discovery, leaving the way clear for Paramount Skydance to win the months-long battle for the historic Hollywood studio.

UK set to enhance regulation of major streamers such as Netflix and Disney+

The UK's biggest video-on-demand services will have to follow the same content and accessibility rules as traditional broadcasters, under new government legislation.

Avatar: Fire and Ash leads at Visual Effects Society awards

Avatar: Fire and Ash was the big winner at the Visual Effects Society’s 24th Annual VES Awards, taking home seven awards in total, including the top prize of Outstanding Visual Effects in a Photoreal Feature.

Charity publishes set of principles for mentally healthy productions

The Film and TV Charity has unveiled its new ‘Principles for Mentally Healthy Productions’ to help address systemic pressures and poor working practices across the UK screen sector, aiming to improve culture and conditions on productions.