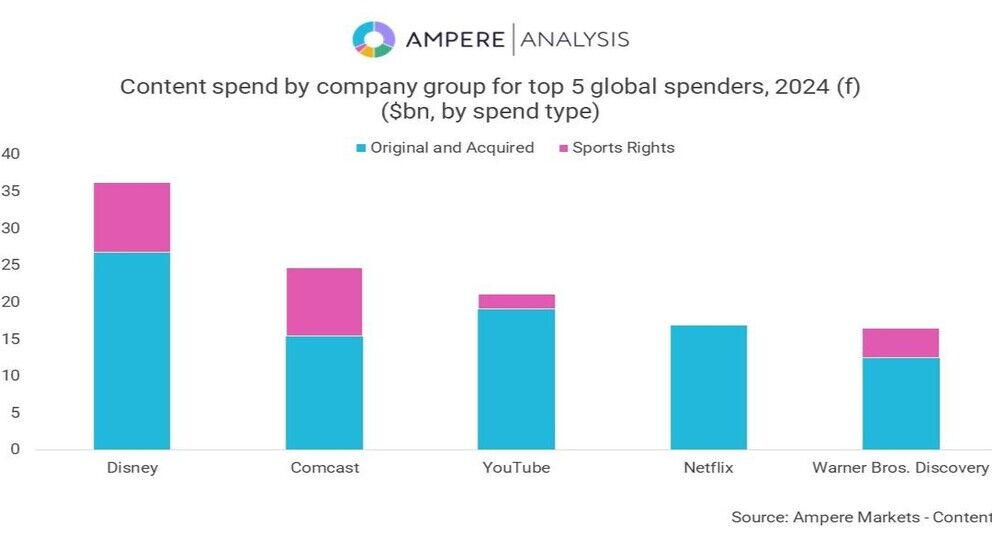

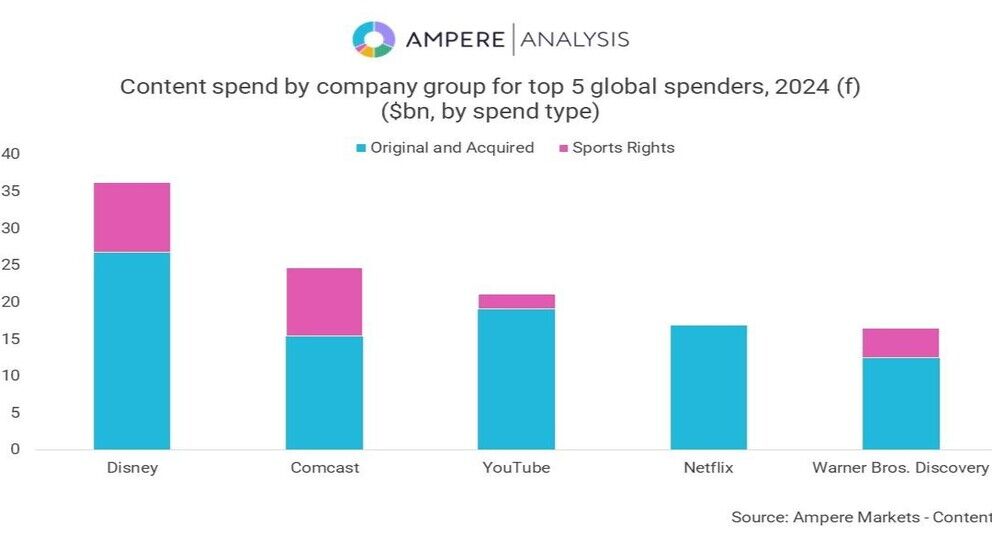

YouTube spends more on content than VoD-first players such as Netflix and Amazon, according to a report from Ampere Analysis.

At nearly $20bn, YouTube is the third biggest investor in content after Disney and Comcast. Not including sports programming, the platform ranks second after Disney.

YouTube’s main source of revenue is advertising, not subscription fees, and the platform is rarely compared to TV or traditional streamers.

YouTube’s content spend consists of its distinct revenue-sharing arrangement with content creators. YouTube’s advertising revenue alone, forecasted at $35 billion in 2024, exceeds Disney+ and Amazon Prime Video’s total earnings and falls just shy of Netflix’s total revenue.

YouTube is the number one platform for online video viewing globally and its advertising revenue is driven by its large user base. In Q1 2024, 83% of all respondents in the Ampere Media – Consumer survey were monthly active users of the platform, ahead of monthly active video viewers for Netflix at 57% and Instagram at 43%.

Jaanika Juntson, Senior Analyst at Ampere Analysis, said: “Despite limited re-licensing opportunities on other platforms, YouTube continues to invest significantly in content through revenue sharing with content creators, and has secured the second highest spot for non-sports content spend globally. YouTube’s unique business model sets the platform apart in the media market yet it plays a key role in the entertainment sector.”

You are not signed in

Only registered users can comment on this article.

Warner Bros Discovery and BBC report strong Winter Olympics viewing

Warner Bros. Discovery (WBD) and the BBC have both reported strong viewership results for their coverage of the Olympic Winter Games for Milano-Cortina 2026.

Sports programming surges on major streaming platforms

Sports programme offerings across the top five subscription video-on-demand (SVOD) services jumped 52% year-over-year, according to research by Gracenote, the content data business unit of Nielsen.

EIT Culture & Creativity becomes IBC2026’s European Innovation Partner

IBC has appointed the EIT Culture & Creativity as its European Innovation Partner for 2026.

Micro-dramas overtake streamers on mobile engagement – report

Micro-dramas are rapidly emerging as one of the fastest-scaling formats in online video, according to research by Omdia.

.jpg)

One Battle After Another leads Bafta winners

Paul Thomas Anderson's comedy-thriller One Battle After Another was the biggest winner at the 2026 Bafta Film Awards, picking up six prizes including best film, best director, and best adapted screenplay for Anderson.